Looking VoIP Solution for Insurance Companies?

We provide fully featured & tailored Insurance phone systems for Companies & Agents since 2012

How The VoIP Shop's Phone solution help the insurance companies’ & clients?

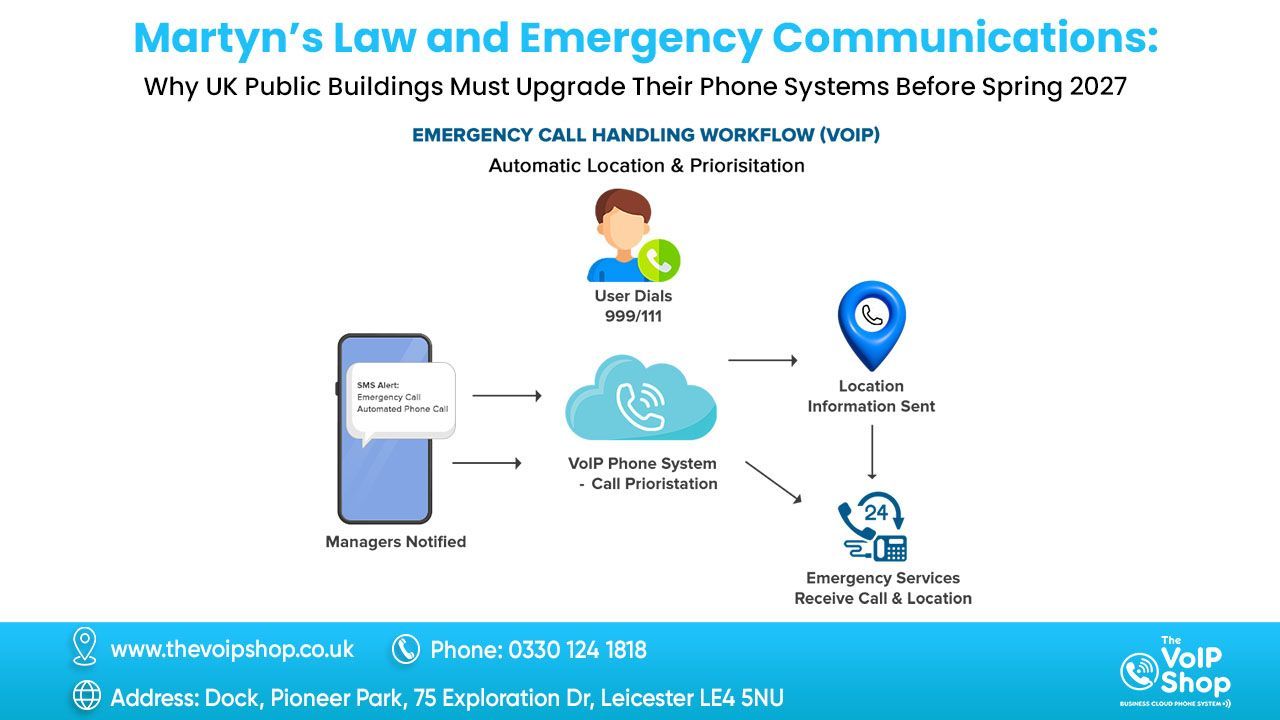

A customer calls an insurance company to report a claim. The agent uses the VoIP solution to record the call, which can be helpful if there are any disputes later on. The agent also uses the IVR system to route the call to the appropriate department, which helps to ensure that the customer is quickly connected with the right person.

An agent is working from home and receives a call from a customer. The agent uses the VoIP Insurance system to answer the call and provide customer service. The agent is able to access the customer's file from the cloud, which allows them to provide more personalized service.

An insurance company has multiple offices across the country. The VoIP Shop Insurance phone service allows agents in different offices to communicate with each other easily. This can be helpful for collaborating on claims or for providing support to customers.

An insurance company is concerned about security. The VoIP insurance agency system offers a number of security features, such as encryption and call authentication. This helps to protect sensitive customer data from fraud.

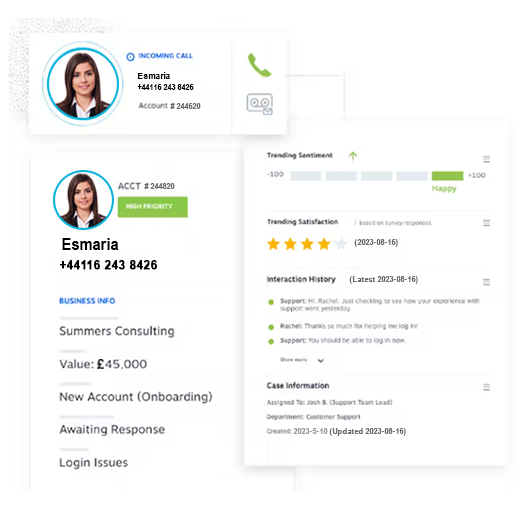

The VoIP Shop: All Your Customer Data in One Place

Insurance agents need to be able to access all their customer data in one place to close more deals and capture more customer referrals. The VoIP Shop's phone service integrates seamlessly with CRM software, giving you a single view of all your customer information. This means you can quickly and easily find the information you need to make informed decisions, provide excellent customer service, and close more deals.

Using The VoIP Shop's insurance phone service for your agency

- Single view of customer data

- Seamless integration with CRM software

- Advanced call features

- 24/7 support

How can The VoIP Shop's Insurance Phone Service save the money for companies?

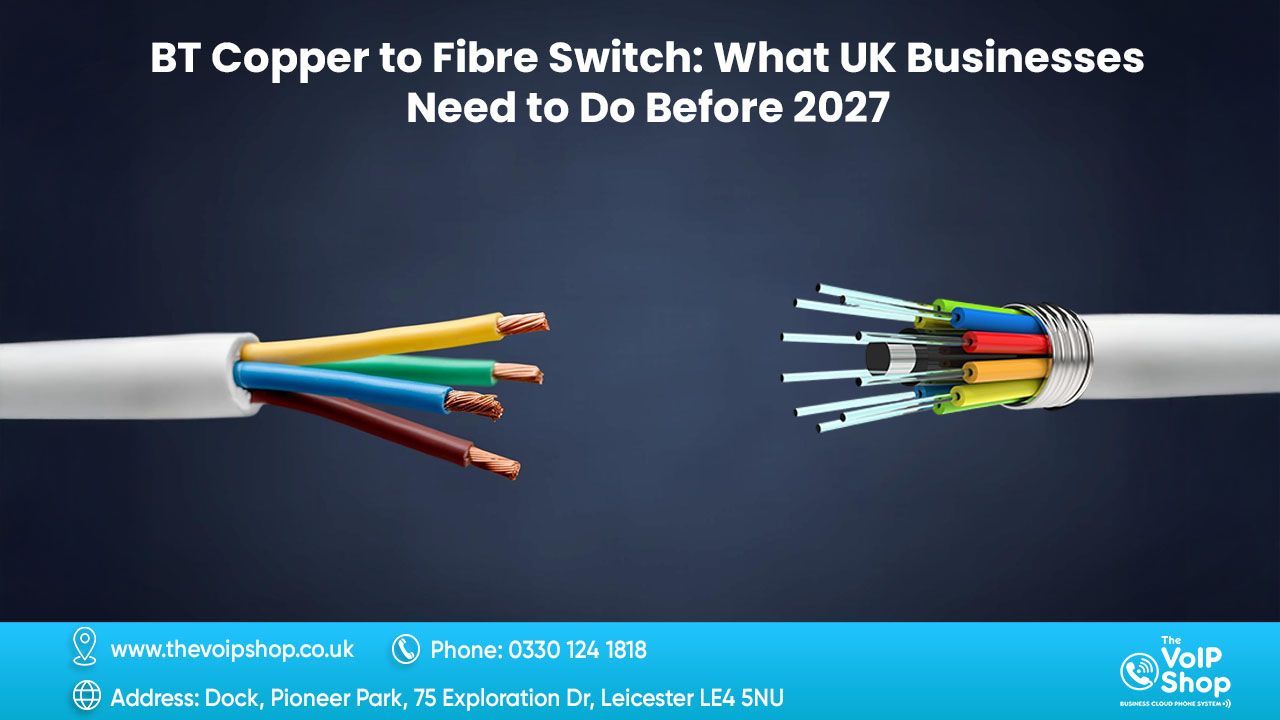

1. Reduced hardware costs

VoIP Insurance systems do not require the same expensive hardware as traditional phone systems. Instead, they use the internet to transmit voice data, which means that insurance companies can save money on things like phone lines, routers, and switches.

2. Lower long-distance and international calling rates

Insurance VoIP providers typically offer much lower rates for long-distance and international calling than traditional phone companies. This can save insurance companies a significant amount of money, especially if they have a lot of customers who live or work in other countries.

3. Eliminated maintenance costs

Insurance phone systems are much easier to maintain than traditional phone systems. There are no physical wires to install or repair, and software updates are typically handled by the VoIP providers. This can save insurance companies a significant amount of money on maintenance costs.

4. Increased flexibility

Insurance agency phone systems offer a great deal of flexibility, which can help companies save money. For example, phone service can be used to create a virtual call center, which can be located anywhere in the world. This can save insurance companies money on office space and staffing costs.

5. Improved customer service

VoIP insurance solution offer a number of features that can improve customer service, such as call recording, call queuing, and call routing. This can help insurance companies resolve customer issues more quickly and efficiently, which can lead to increased customer satisfaction and loyalty.

6. Reduced staffing costs

VoIP Insurance phone solution can help companies reduce staffing costs by enabling them to consolidate their call centers. This can be done by routing calls to agents in different locations, based on their skill set or availability.

How the agencies benefit from using The VoIP Shop Insurance system?

Cost savings: VoIP can save insurance companies a significant amount of money on their phone bills. This is because VoIP calls are made over the internet, which is much cheaper than traditional landline calls. For example, a large insurance company with 1,000 employees could save an average of $300,000 per year by switching to VoIP.

Flexibility: VoIP is a very flexible solution that can be used by insurance companies of all sizes. It can be scaled up or down as needed, and it can be used by agents who work remotely. This is important for insurance companies that need to be able to adapt to changing customer needs and market conditions.

Improved security: VoIP insurance systems can be more secure than traditional landline systems. This is because VoIP calls are encrypted, which helps to protect customer data. This is especially important for insurance agencies that handle sensitive customer information, such as medical records and financial information.

Increased productivity: VoIP can help insurance companies increase their productivity by providing features such as call recording, call monitoring, and call routing. These features can help agents to resolve customer issues more quickly and efficiently. For example, a study by the Aberdeen Group found that insurance companies that use VoIP have a 20% higher customer satisfaction rate and a 15% lower call abandonment rate than those that don't.

Get a 360-Degree View of Your Insurance Customers With

Our New Customer History Tool

- See conversation history, policy details, and claims as soon as they call.

- Access insurance renewals, quotes, and policies in one place.

- Save time and improve customer satisfaction with our easy-to-use interface.

Robust Call Routing

Make sure your customers are getting the best service they deserve with Robust Call Routing. Our fully featured insurance phone systems are designed specifically for agencies. We provide intuitive routing to the right person for each call, so you can guarantee all of your customers get the prompt attention they need.

If you are looking for a way to improve the efficiency, customer satisfaction, and security of your insurance agency's call center, then Robust Call Routing is the perfect solution for you.

Get in touch with us today to learn more about how Robust Call Routing can help your business.

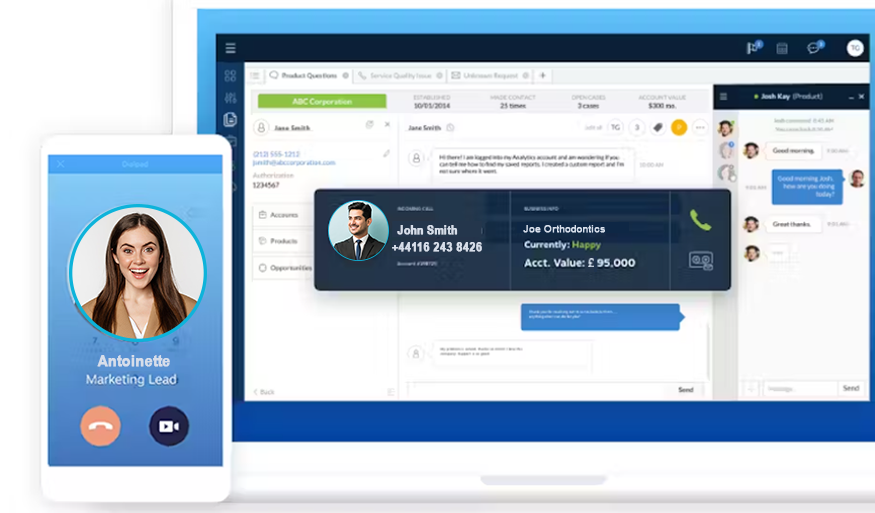

Desktop app

Are you struggling to maintain seamless communication with your clients? With the Webex Desktop app, you can activate comprehensive and customized insurance phone solutions ideally suited for agencies. Whether you're an Insurance Agent, Broker, or Claims Adjuster, stay effortlessly connected with your clients without interruptions.

Access an array of functionalities, including call forwarding, voicemail, IVR, and more, all within a user-friendly interface. Embrace the transition now and discover the prowess of Webex firsthand.

Through the Webex Desktop App, you'll efficiently handle all your calls from any location, utilizing the same dependable and uncomplicated configuration. Take a decisive step towards elevating your insurance agency with our tailored insurance phone system, designed to empower your operations.

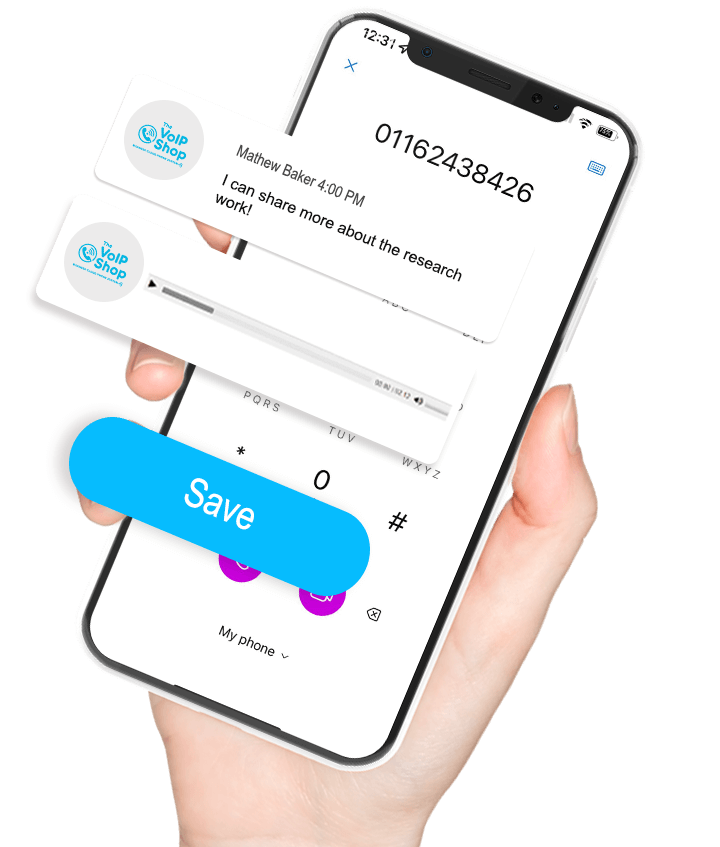

Truly Mobile Ready

Transition to the Webex Mobile app customized for Insurance Agencies and unlock the perfect fusion of mobile convenience and the unwavering performance of a comprehensive business phone network! You'll enjoy complete access to essential features that streamline your operations through Webex Mobile. Prepare to enhance efficiency, boost client contentment, and orchestrate your insurance agency with unparalleled precision.

Embark on your Webex Mobile journey today and encounter the transformative impact firsthand!

Enhanced collaboration

Elevate your insurance agency's teamwork with Advanced Collaboration. Our phone service are designed to cater to your unique agency requirements. Featuring cutting-edge functionalities such as virtual attendants, transcribed voicemail, call logging, and beyond, you can uphold seamless connections and manage client calls with precision. Embrace the finest in industry-grade phone systems now, and encounter heightened collaboration within your insurance company.

Why The VoIP Shop is trusted VoIP Insurance Service Provider for Agencies in UK?

The VoIP Shop

The VoIP Shop is a UK-based VoIP provider that offers a wide range of features and services to businesses of all sizes. They are known for their excellent customer service and their commitment to providing a high-quality VoIP experience.

Why choose:

The VoIP Shop is a great choice for insurance companies because they offer a number of features that are specifically designed for this industry. These features include:

Plans: The VoIP Shop offers a variety of plans to suit size of the insurance, with prices starting at £10 per user per month.

Special features for insurance companies:

- HIPAA compliance: This ensures that all calls are secure and confidential.

- CRM integration: This allows insurance companies to integrate their VoIP system with their CRM software, making it easier to manage customer data.

- PCI compliance: This ensures that all credit card transactions are secure.

Advantages

- Excellent customer service

- Wide range of features

- HIPAA compliant

- Affordable pricing

FAQs

Answers to some of our most commonly asked Insurance phone System for Companies & Agents